Alright, let’s talk about money but without the anxiety, okay? We all know we should be budgeting, but the thought of complicated software and endless charts can be a real drag. That’s where the humble, yet mighty, printable monthly budget spreadsheet comes to the rescue! Think of it as your financial chill pill. It’s a simple, tangible way to see where your money’s going, so you can finally take control and stop that end-of-the-month “OMG, where did it all go?!” panic. Forget those fancy apps with bells and whistles you’ll never use. We’re going back to basics, people! This isn’t about deprivation; it’s about awareness. When you actually see those numbers staring back at you from a piece of paper, you start to make smarter choices almost automatically. It’s like magic, but with math (don’t worry, the math is easy!). A solid spreadsheet will not only show you the numbers, but it will allow you to physically write down, cross out, and update numbers as the month goes on. This is a great visual cue and will keep your goal at the forefront of your decisions. Plus, theres the satisfaction of physically checking things off a list it’s way more rewarding than tapping a button on your phone.

Why Choose a Printable Budget Spreadsheet? (Seriously, Hear Me Out!)

Okay, so maybe you’re thinking, “Printable? In this day and age? Isn’t that, like, super old-school?” And yeah, you’re right, it’s not exactly cutting-edge technology. But that’s precisely why it’s so darn effective! First off, no distractions. No notifications popping up, no tempting social media feeds just a click away. Just you, your budget, and maybe a cup of coffee. Its a mindful experience, forcing you to actually think about your spending habits. Second, it’s totally customizable. You’re not stuck with someone else’s categories or formulas. You can tweak it to fit your exact needs and lifestyle. Are you a coffee addict? Add a “Coffee Shop Fund” category! Love to travel? Dedicate a section to “Adventure Savings.” Make it your own! Thirdly, it’s budget-friendly (pun intended!). No subscription fees, no hidden costs. Just download a free template (or create your own), print it out, and you’re good to go. Seriously, what’s not to love? And finally, let’s be honest, there’s something satisfying about physically writing things down. It feels more real, more concrete than just typing numbers into a screen. It’s a connection to your finances that you just don’t get with digital tools. Plus, it makes you feel really organized, like you’ve got your life together (even if you don’t…yet!).

1. Finding the Perfect Printable Budget Spreadsheet Template

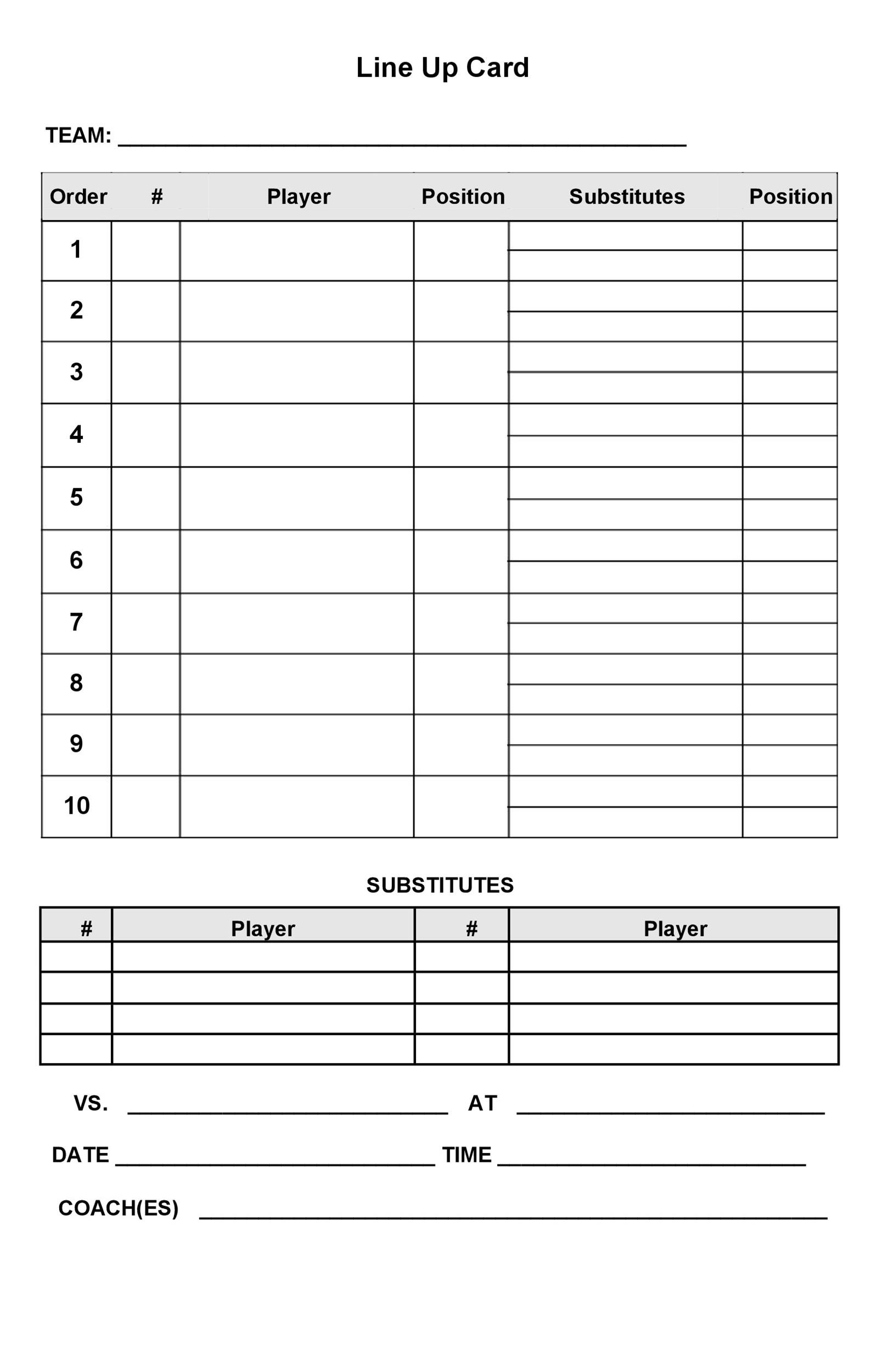

So, you’re sold on the idea of a printable budget spreadsheet, but now you’re facing the daunting task of actually finding one that works for you. Don’t worry, the internet is your friend! There are tons of free templates available online, from super basic to more detailed and complex. The key is to find one that fits your personality and your specific financial needs. Start by searching for “[keyword]” or even “free budget template” you’ll be flooded with options. Look for templates that have clear headings, easy-to-understand formulas (if any), and enough space to write comfortably. Consider what categories are most important to you. Do you need a separate section for student loans? Or maybe a detailed breakdown of your entertainment expenses? Choose a template that includes those categories or that allows you to easily add them. Don’t be afraid to try out a few different templates before you settle on one that you love. Print them out, fill them in for a month, and see which one feels the most intuitive and helpful. Remember, this is supposed to make your life easier, not more complicated! Also, check out various sources, like personal finance blogs, budgeting websites, and even online office supply stores. They often have free templates available as a lead magnet to get you in the door. The goal is to find a spreadsheet that looks good, is functional, and inspires you to actually use it! Make sure the spreadsheet offers the ability to track spending over time, in addition to simply listing out a budget. Many people are good at figuring out how much to spend, but actually tracking the spending is where it all falls apart.

2. Customizing Your Spreadsheet for Maximum Budgeting Power

Alright, you’ve found the perfect template, but don’t just start filling it in willy-nilly! Take some time to customize it to fit your unique financial situation. This is where the real magic happens. Start by adding or deleting categories as needed. If you don’t have a car payment, get rid of that row! If you have a specific hobby that requires a lot of spending, add a “Hobby Fund” category. The more personalized your spreadsheet is, the more likely you are to stick with it. Next, think about your income. Do you have multiple income streams? Make sure to list them all out separately. This will give you a clear picture of your total income and help you allocate your funds accordingly. Now, for the fun part: expenses! This is where you really need to be honest with yourself. Track your spending for a month (or even just a week) to get a sense of where your money is actually going. You might be surprised! Use a notebook, a budgeting app, or even just your bank statements to keep track of every single expense, no matter how small. Then, categorize those expenses and plug them into your spreadsheet. Don’t forget to include both fixed expenses (like rent and utilities) and variable expenses (like groceries and entertainment). Also, consider adding some visual cues to your spreadsheet to make it more appealing and easier to use. Use color-coding to highlight different categories, add borders to separate sections, or even include a few motivational quotes to keep you on track. And finally, don’t be afraid to experiment! Try out different layouts, formulas, and tracking methods until you find a system that works best for you. Remember, this is your budget, so make it your own!

3. Tracking Your Expenses Like a Pro (No More Guesswork!)

Okay, so you’ve got your customized spreadsheet all set up, now comes the crucial part: actually tracking your expenses! This is where most people fall off the wagon, but don’t let that be you! The key is to make it a habit. Set aside a few minutes each day (or at least a few times a week) to update your spreadsheet with your latest spending. The more frequently you track, the more accurate your budget will be. There are several ways to track your expenses. You can use a notebook to jot down every purchase as you make it, or you can use a budgeting app on your phone to automatically track your spending. You can also review your bank statements and credit card bills regularly to see where your money is going. Choose the method that works best for you and stick with it. Be sure to include every single expense, no matter how small. Those little coffee shop trips and impulse purchases can really add up! Don’t underestimate the power of small changes, they really do compound over time. Categorize your expenses accurately. This will help you see where you’re overspending and identify areas where you can cut back. And don’t forget to reconcile your spreadsheet with your bank statements regularly to make sure everything matches up. This will help you catch any errors or fraudulent activity. Finally, be patient with yourself. It takes time to develop good budgeting habits. Don’t get discouraged if you slip up occasionally. Just get back on track as soon as possible and keep moving forward. Remember, every little bit helps!

4. Analyzing Your Budget and Achieving Financial Freedom

You’ve been diligently tracking your expenses for a few months, and now it’s time to take a step back and analyze your budget. This is where you can really start to see the fruits of your labor! Start by comparing your actual spending to your budgeted amounts. Are you overspending in certain categories? If so, identify the reasons why and make adjustments to your budget accordingly. Are you underspending in other categories? Maybe you can reallocate those funds to your savings goals or pay down debt. Look for trends in your spending. Are you consistently overspending on weekends? Maybe you need to plan some free or low-cost activities to keep you on track. Are you spending a lot of money on eating out? Maybe you can start cooking more meals at home. Identify areas where you can cut back your spending. Even small changes can make a big difference over time. Can you cancel a subscription you’re not using? Can you negotiate a lower rate on your cable bill? Can you pack your lunch instead of buying it? And finally, celebrate your successes! Every time you reach a financial goal, reward yourself (in a budget-friendly way, of course!). This will help you stay motivated and keep you on track. Remember, budgeting is a marathon, not a sprint. It’s a long-term process that requires patience, discipline, and a willingness to adapt. But with a little effort, you can achieve financial freedom and live the life you’ve always dreamed of. By continually monitoring your budget, you will be able to spot trends as they begin to form. The sooner you notice a trend, the easier it will be to change course if need be.

Conclusion

The preceding exploration of the printable monthly budget spreadsheet has outlined its fundamental role in personal financial management. It serves as a tangible tool for tracking income, categorizing expenses, and facilitating informed financial decision-making. The adaptability of the printable format allows for customization to individual needs, promoting a greater sense of ownership and control over one’s financial resources. Furthermore, its simplicity minimizes distractions and encourages mindful engagement with budgeting processes.

As individuals navigate increasingly complex financial landscapes, the utilization of a printable monthly budget spreadsheet represents a proactive step toward achieving financial clarity and stability. Its continued relevance lies in its accessibility and its capacity to empower users to take charge of their financial well-being. Consider implementing or refining this methodology to foster long-term financial health and security.