Let’s face it, managing household finances can feel like navigating a minefield. Between bills, groceries, unexpected expenses, and the ever-present temptation of that new gadget, it’s easy to lose track of where your money is going. But fear not, because in 2024, you have a secret weapon at your disposal: printable household budget forms! These aren’t your grandma’s dusty ledgers (though, respect to grandma!). These are modern, customizable, and incredibly effective tools to help you take control of your financial destiny. Think of them as your personalized roadmap to financial success. They provide a clear visual representation of your income and expenses, making it easy to identify areas where you can cut back and save. Whether you’re a seasoned budgeter or a complete newbie, a printable form can be a game-changer. You might be thinking, Why bother with paper when there are so many apps? Well, sometimes, unplugging and getting hands-on is the best way to truly connect with your finances. Plus, there’s something incredibly satisfying about physically writing down your goals and tracking your progress. So, buckle up, grab a pen, and let’s dive into the wonderful world of printable budgeting!

Why Choose Printable Budget Forms? The Perks You Need to Know

In an age of digital everything, you might wonder why anyone would still opt for a printable budget form. Well, there are actually several compelling reasons why these tried-and-true tools are still incredibly popular in 2024. First and foremost, they offer a tangible and visual representation of your finances. Staring at a spreadsheet on your computer screen can feel detached and impersonal. But physically writing down your income and expenses creates a stronger connection to your money. This tactile approach can help you become more mindful of your spending habits and more committed to your financial goals. Secondly, printable forms eliminate distractions. When you’re working on a budget app, it’s easy to get sidetracked by notifications, social media, or other online temptations. But with a paper form, you can focus solely on your finances without any digital interruptions. Thirdly, they offer flexibility and customization. You can easily find a form that suits your specific needs and preferences, whether you prefer a simple template or a more detailed one. And you can customize it to track specific expenses, such as debt repayment or savings goals. Finally, many find the act of physically writing things down to be more memorable and engaging. There’s a certain satisfaction in putting pen to paper and seeing your progress unfold before your eyes. So, don’t underestimate the power of the printable budget form in your quest for financial freedom.

1. Types of Printable Household Budget Forms to Suit Your Style

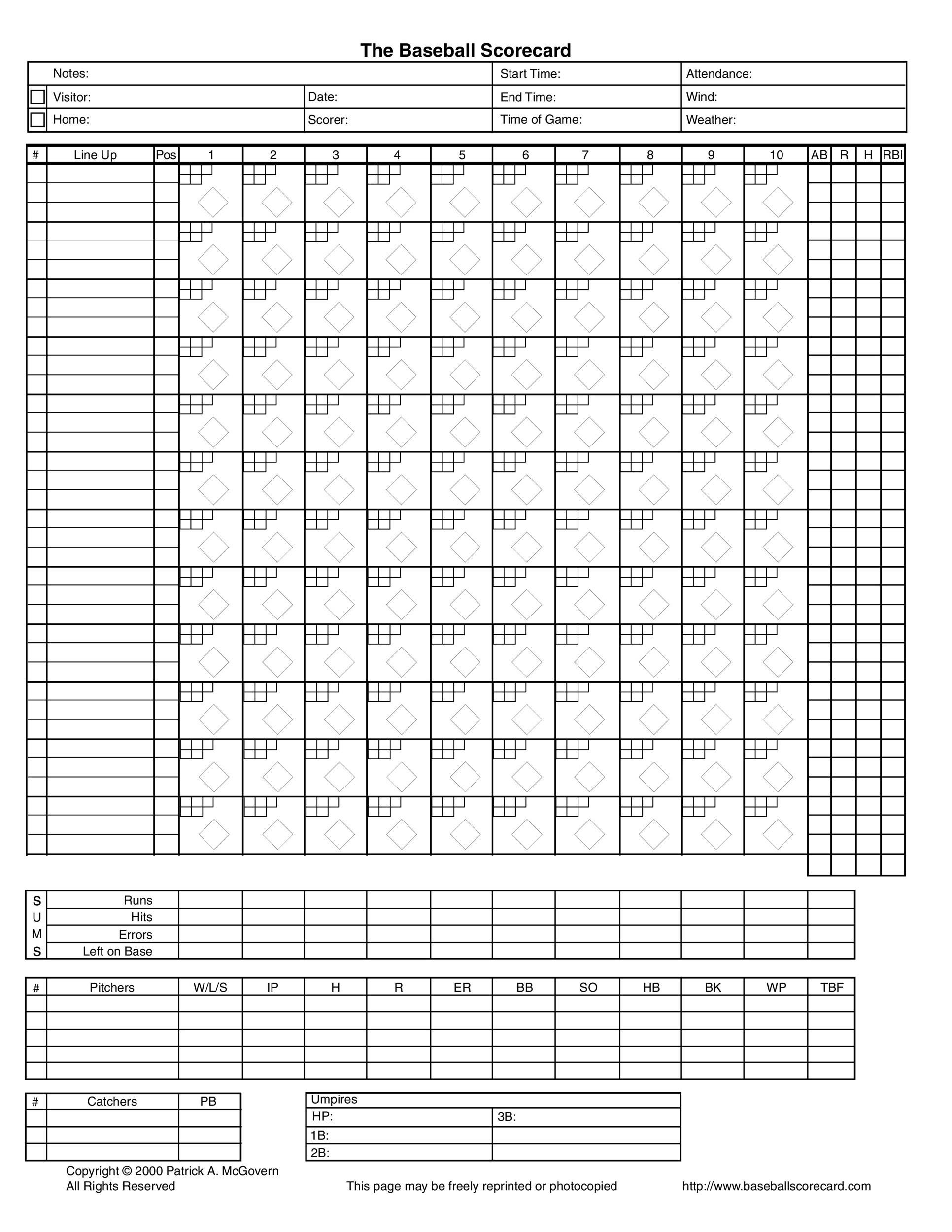

The beauty of printable budget forms lies in their versatility. There’s a style out there to suit every personality and financial situation. Let’s explore some popular options you’ll find readily available in 2024. First, we have the classic monthly budget form. This is a simple, straightforward template where you list your income and expenses for each month. It’s a great option for beginners who want to get a basic overview of their cash flow. Then, there’s the zero-based budget form. This approach requires you to allocate every single dollar of your income, ensuring that nothing is left unaccounted for. It’s a more intensive method, but it can be incredibly effective for controlling spending and achieving specific financial goals. For those who prefer a more detailed approach, there are budget forms that break down expenses into specific categories, such as housing, transportation, food, and entertainment. This allows you to identify areas where you’re overspending and make targeted adjustments. And if you’re tackling debt, there are specialized debt snowball or debt avalanche forms to help you track your progress and stay motivated. Finally, don’t forget the calendar-based budget form, which allows you to visualize your expenses throughout the month and identify potential gaps or opportunities for savings. No matter your style or financial needs, there’s a printable budget form out there that’s perfect for you.

Now, let’s delve a little deeper into the nitty-gritty of using these forms effectively. First, gather all your financial information. This includes your income statements, bank statements, credit card bills, and any other documents that provide insight into your cash flow. Be thorough and accurate, as this will form the foundation of your budget. Next, categorize your expenses. This is where you’ll break down your spending into categories like housing, transportation, food, entertainment, and so on. Be as specific as possible, as this will help you identify areas where you can cut back. Then, estimate your income and expenses for the month. This is where you’ll make your best guess about how much money you’ll earn and spend in each category. Don’t be afraid to adjust your estimates as the month progresses. Now, the fun part: track your actual spending! This is where you’ll record every dollar you spend, noting the date, amount, and category. Be diligent and honest, as this is the only way to get an accurate picture of your spending habits. At the end of the month, compare your actual spending to your estimated spending. This will reveal where you’re on track and where you need to make adjustments. Finally, don’t be afraid to experiment with different budget forms and strategies until you find what works best for you. Budgeting is a personal process, so find a method that you enjoy and that helps you achieve your financial goals.

Maximizing Your Budgeting Efforts

Okay, so you’ve got your printable budget form, you’ve gathered your financial information, and you’re ready to start tracking your spending. But how do you ensure that your budgeting efforts are as effective as possible in 2024? Here are some tips and tricks to help you maximize your results. First, set realistic goals. Don’t try to overhaul your entire financial life overnight. Start small and focus on making gradual changes over time. This will make the process more manageable and sustainable. Next, automate your savings. Set up automatic transfers from your checking account to your savings account each month. This will ensure that you’re consistently saving money without having to think about it. Third, find ways to reduce your expenses. Look for areas where you can cut back on spending, such as eating out less, canceling unnecessary subscriptions, or finding cheaper alternatives for your favorite products. Fourth, track your progress regularly. Don’t just set it and forget it. Check in with your budget at least once a week to see how you’re doing and make any necessary adjustments. This will help you stay on track and avoid overspending. Fifth, reward yourself for your progress. When you reach a financial milestone, celebrate your success with a small treat or activity. This will help you stay motivated and engaged in the budgeting process. Sixth, don’t be afraid to ask for help. If you’re struggling to manage your finances, seek out advice from a financial advisor or a trusted friend or family member. There’s no shame in asking for help, and it can make a big difference in your financial well-being. And lastly, remember that budgeting is a journey, not a destination. There will be ups and downs along the way, but the important thing is to stay committed to your goals and keep moving forward. With a little effort and persistence, you can achieve financial freedom and live the life you’ve always dreamed of.

Printable Household Budget Forms

This examination underscores the enduring value of printable household budget forms as a fundamental tool for personal financial management. The simplicity and tangibility of these forms offer distinct advantages in fostering financial awareness and promoting disciplined spending habits. Their adaptability to individual needs and preferences ensures continued relevance in diverse economic circumstances.

The proactive adoption of structured budgeting, whether through physical templates or digital alternatives, remains a cornerstone of long-term financial stability. Individuals are encouraged to leverage available resources to cultivate informed financial practices, paving the way for greater economic security and achievement of financial objectives.