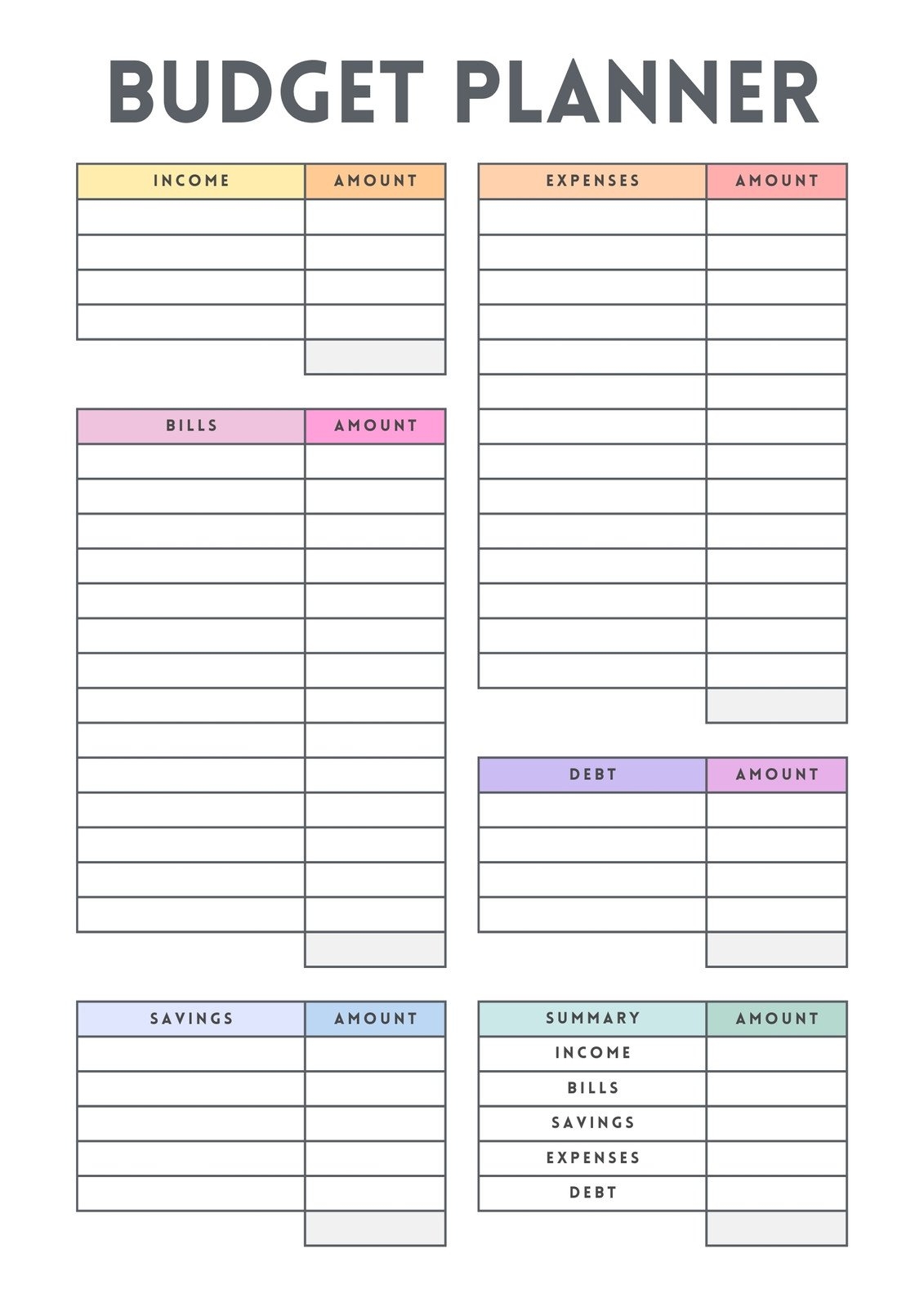

Okay, let’s face it. Budgeting. The word itself can trigger a wave of anxiety. Visions of spreadsheets, restrictions, and saying “no” to everything fun dance in your head. But what if I told you there was a way to take control of your finances without feeling like you’re sacrificing your entire life? Enter the magical world of printable budget templates! These aren’t your grandma’s dusty ledger books. We’re talking about beautifully designed, easy-to-use documents that can help you track your income, expenses, and savings goals. Think of them as your financial co-pilot, guiding you towards a stress-free future where you actually know where your money is going. Forget complicated software and confusing formulas. With a printable template, all you need is a printer, a pen, and a little bit of motivation. You can find a template that perfectly suits your needs, whether you’re a student living on ramen noodles, a young professional building your career, or a family juggling multiple expenses. So, ditch the financial chaos and embrace the simplicity of printable budget templates. Your wallet (and your sanity) will thank you. This article is your comprehensive guide to understanding, utilizing, and ultimately thriving with these readily available resources in 2024. We’ll explore the different types, how to choose the right one for you, and even offer tips on staying consistent. Let’s get started on your journey to financial freedom!

Why Printable Budget Templates are Still a Game-Changer in a Digital World

In a world saturated with budgeting apps and sophisticated financial software, you might be wondering why anyone would still bother with a printable template. Aren’t they a bit… outdated? The answer, surprisingly, is a resounding no! Printable templates offer a unique set of advantages that digital tools simply can’t replicate. First and foremost, they provide a tangible connection to your finances. There’s something powerful about physically writing down your income and expenses. It forces you to be more mindful of where your money is going and helps you develop a stronger sense of awareness. Secondly, they offer unparalleled simplicity. No need to learn complex software or navigate confusing interfaces. Just print, fill, and analyze. This makes them perfect for beginners or anyone who prefers a straightforward approach. Furthermore, printable templates eliminate the risk of data breaches or privacy concerns. You don’t have to worry about your financial information being stored in the cloud or shared with third parties. Your budget remains private and secure within the confines of your own home. Think about the times when technology fails you a dead phone battery, a software glitch, or a lost internet connection. A printable template is always there, ready to help you stay on track. It’s a reliable, low-tech solution that you can count on, regardless of external circumstances. In 2024, as we navigate an increasingly digital landscape, the simplicity and tangibility of printable budget templates remain a valuable asset for anyone seeking to improve their financial well-being.

1. Different Types of Printable Budget Templates to Suit Every Need

One of the best things about printable budget templates is the sheer variety available. There’s a template out there for virtually every financial situation and personality. Let’s explore some of the most popular types: The Traditional Monthly Budget: This is the classic template, perfect for those who want a comprehensive overview of their monthly income and expenses. It typically includes sections for income, fixed expenses (rent, utilities, loan payments), variable expenses (groceries, entertainment, transportation), and savings goals. The Zero-Based Budget: With this method, every dollar is assigned a purpose, ensuring that your income minus your expenses equals zero. It’s a great way to be intentional about your spending and avoid impulse purchases. The 50/30/20 Budget: This simple approach allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. It’s a good option for those who want a balanced approach to budgeting. The Debt Snowball/Avalanche Budget: These templates are designed to help you pay off debt faster. The snowball method focuses on paying off the smallest debt first, while the avalanche method prioritizes debts with the highest interest rates. The Envelope Budget: This system involves allocating cash to different spending categories and physically placing the money in envelopes. Once the envelope is empty, you can’t spend any more in that category. It’s a great way to control impulsive spending. The Project-Based Budget: This template is designed for specific projects, such as home renovations or wedding planning. It helps you track expenses and stay within budget for a particular goal. The important thing is to experiment with different templates and find one that resonates with you and fits your lifestyle. Don’t be afraid to customize a template to make it your own. The goal is to create a system that you can stick with consistently.

2. Choosing the Right Printable Budget Template for Your Unique Situation

Selecting the perfect printable budget template can feel overwhelming with so many options available. However, by considering your individual circumstances and financial goals, you can narrow down the choices and find a template that truly works for you. Start by assessing your current financial situation. Are you struggling with debt? Do you have trouble tracking your spending? Are you saving for a specific goal? Your answers to these questions will help you determine the type of template that best addresses your needs. If you’re drowning in debt, a debt snowball or avalanche template might be the most effective choice. If you tend to overspend, an envelope budget or a zero-based budget could help you regain control. Next, consider your personality and preferred budgeting style. Are you a detail-oriented person who enjoys tracking every penny? Or do you prefer a more simplified approach? If you love data and analysis, a traditional monthly budget might be a good fit. If you prefer simplicity and flexibility, the 50/30/20 budget could be a better option. Also, think about your lifestyle and spending habits. Do you have a lot of fixed expenses or mostly variable expenses? Do you eat out frequently or cook at home? Your spending patterns will influence the level of detail you need in your template. If you have a lot of variable expenses, you’ll want a template that allows you to track them easily. Don’t be afraid to try out different templates before settling on one. Print out a few different options and experiment with them for a week or two. See which one feels the most comfortable and intuitive. Remember, the best budget template is the one that you’ll actually use consistently. Finally, look for templates that are customizable. You may need to adjust the categories or add new sections to fit your specific needs. A good template should be flexible enough to adapt to your changing circumstances.

3. Tips for Staying Consistent with Your Printable Budget Template

Okay, you’ve chosen the perfect printable budget template. Congratulations! But the hard work isn’t over yet. The real challenge is staying consistent and making budgeting a regular habit. Here are some tips to help you stay on track: Set Realistic Goals: Don’t try to overhaul your entire financial life overnight. Start with small, achievable goals, such as tracking your spending for a week or cutting back on one unnecessary expense. Gradually increase your goals as you become more comfortable with the process. Schedule Regular Budgeting Time: Treat budgeting like any other important appointment. Schedule a specific time each week or month to review your finances and update your template. This will help you stay organized and avoid falling behind. Track Your Expenses Diligently: The more accurately you track your expenses, the more effective your budget will be. Use a notebook, a spreadsheet, or a budgeting app to record every purchase, no matter how small. Be honest with yourself about your spending habits. Find an Accountability Partner: Share your budgeting goals with a friend, family member, or financial advisor. Having someone to hold you accountable can make a big difference in your consistency. Celebrate Your Successes: When you reach a financial goal, reward yourself with something small. This will help you stay motivated and reinforce positive budgeting habits. Don’t Get Discouraged by Setbacks: Everyone makes mistakes. If you overspend in one category, don’t give up on your budget entirely. Simply learn from your mistake and adjust your spending accordingly. Remember, budgeting is a journey, not a destination. Focus on progress, not perfection. Review and Adjust Your Budget Regularly: Your financial situation is likely to change over time. As your income increases or your expenses shift, be sure to review and adjust your budget accordingly. This will ensure that your template remains relevant and effective. By following these tips, you can turn budgeting from a chore into a rewarding habit that helps you achieve your financial goals.

Where to Find the Best Printable Budget Templates Online in 2024

The internet is a treasure trove of printable budget templates, but navigating the sheer volume of options can be overwhelming. To save you time and effort, here are some reputable sources where you can find high-quality templates in 2024: Microsoft Office Templates: Microsoft offers a wide variety of free budget templates that you can download and customize in Excel or Word. These templates are generally well-designed and easy to use. Vertex42: This website specializes in spreadsheet templates for various purposes, including budgeting. They offer a range of free and premium templates, including traditional monthly budgets, zero-based budgets, and debt payoff trackers. PrintableBudget.com: As the name suggests, this website is dedicated to providing printable budget templates. They offer a wide variety of free templates, including simple monthly budgets, detailed expense trackers, and goal-based savings plans. TheBalance.com: The Balance offers a wealth of personal finance information, including a collection of free printable budget templates. Their templates are designed to be user-friendly and customizable. Dave Ramsey’s Website: Dave Ramsey is a well-known personal finance expert who advocates for a debt-free lifestyle. His website offers a free budget form that you can download and print. Etsy: If you’re looking for more visually appealing and creative budget templates, Etsy is a great place to start. You can find a wide variety of unique designs from independent sellers. Before downloading any template, be sure to check its reviews and ratings. Look for templates that are well-organized, easy to understand, and customizable to your specific needs. Also, pay attention to the file format. Most templates are available in Excel, Word, or PDF format. Choose the format that you’re most comfortable using. With a little bit of research, you can find the perfect printable budget template to help you take control of your finances in 2024.

Printable Budget Templates

This exploration of printable budget templates has elucidated their enduring relevance within the realm of personal finance management. The discussion spanned the foundational characteristics, diverse applications, and selection criteria, underscoring their utility as a structured tool for financial awareness and planning. The tangible nature and inherent simplicity of these templates offer a direct engagement with financial data, fostering a more conscious approach to resource allocation. Considerations for template selection necessitate a careful evaluation of individual financial circumstances and goals, ensuring the chosen tool aligns with specific needs and preferences.

In conclusion, printable budget templates represent a pragmatic resource for individuals seeking to gain control over their financial landscape. Their accessibility and adaptability position them as a valuable asset in pursuing financial stability and achieving long-term objectives. While digital alternatives exist, the focused application and tangible engagement afforded by these planning aids maintain their significance in contemporary financial practices. The proactive adoption of a suitable template can serve as a cornerstone for responsible fiscal management.