Feeling overwhelmed by your finances? You’re not alone! Many people struggle to keep track of their income and expenses, leading to stress and a lack of financial control. But what if I told you there was a simple, effective, and totally FREE way to take charge of your money? Enter the world of budget worksheet printables! These aren’t your grandma’s dusty ledgers (unless your grandma is a financial whiz, in which case, high five to her!). These are modern, customizable templates designed to help you visualize your finances, understand your spending habits, and achieve your financial goals, whether it’s saving for a dream vacation, paying off debt, or simply building a solid financial foundation for the future. Think of them as your personalized financial command center, ready to guide you towards a brighter, more secure tomorrow. Forget complicated budgeting apps and confusing spreadsheets; a printable offers a tactile, hands-on approach that many find more engaging and less intimidating. We’re going to dive deep into the world of these incredible tools, exploring their benefits, the different types available, and how to choose the perfect one for your unique needs.

Why Choose a Printable Budget Worksheet? Ditch the Tech Overload!

In today’s digital age, it might seem counterintuitive to reach for a pen and paper when managing your finances. But there’s a reason why printable budget worksheets remain incredibly popular! One of the biggest advantages is their simplicity. No need to learn complicated software or worry about syncing issues. Just print, grab a pen, and start tracking! This makes them incredibly accessible for everyone, regardless of their tech skills. Furthermore, the act of physically writing down your income and expenses can be more engaging and help you become more mindful of your spending habits. Studies have shown that handwriting can improve memory and retention, meaning you’re more likely to remember where your money is going when you physically write it down. Another key benefit is the lack of distractions. When using a budgeting app on your phone, you’re just one notification away from getting sidetracked by social media or online shopping. A printable offers a focused, distraction-free environment, allowing you to concentrate on your finances and make informed decisions. Plus, let’s be honest, sometimes it’s just nice to unplug and disconnect from the digital world for a while. Using a printable budget worksheet can be a therapeutic and mindful activity, allowing you to connect with your finances on a deeper level.

1. Beyond the App

Let’s delve deeper into the specific advantages a printable budget offers over its digital counterparts. First, there’s the issue of customization. While some budgeting apps offer customization options, they often come with limitations. With a printable, you have complete control over the layout, categories, and level of detail. You can tailor it to perfectly fit your unique financial situation and preferences. Are you a visual learner? Use different colors to highlight key areas. Do you prefer to track your expenses daily? Create a daily tracking section. The possibilities are endless! Next, consider the issue of privacy. Some people are hesitant to store their financial information on a cloud-based app, fearing data breaches or privacy concerns. A printable offers a secure and private way to manage your finances. You control who has access to your budget and your financial data remains safely in your hands. Also, printables are often easier to share with a financial advisor or partner when discussing financial goals. This allows for clear, open communication and ensures everyone is on the same page. They can be a great tool for teaching children about budgeting and financial responsibility, because of the tangible, visual nature of the worksheet, and the lack of technology, it provides a less intimidating learning environment for younger audiences. They offer so many benefits, and are a great way to gain control of your finances!

Exploring Different Types of Budget Worksheet Printables

Now that you’re convinced of the benefits, let’s explore the different types of budget worksheets available. The classic monthly budget is a staple, providing a comprehensive overview of your income and expenses for a given month. These often include sections for income, fixed expenses (rent, mortgage, utilities), variable expenses (groceries, entertainment), savings goals, and debt repayment. Another popular option is the zero-based budget, which requires you to allocate every dollar of your income to a specific category, ensuring that your income minus your expenses equals zero. This method can be incredibly effective for identifying areas where you can cut back on spending and allocate more money towards your financial goals. For those struggling with debt, a debt snowball or debt avalanche worksheet can be invaluable. These worksheets help you prioritize your debt repayment efforts, either by focusing on the smallest debts first (snowball method) or the debts with the highest interest rates (avalanche method). And don’t forget about specialized worksheets for specific financial goals, such as saving for a down payment on a house, planning a wedding, or tracking your expenses during a vacation. By understanding the different types of budget worksheets available, you can choose the one that best suits your needs and helps you achieve your unique financial aspirations.

2. Customizing Your Worksheet

Beyond choosing the right type of worksheet, customization is key to maximizing its effectiveness. Start by identifying your specific financial goals. What are you hoping to achieve by using a budget? Are you trying to save more money, pay off debt, or simply gain a better understanding of your finances? Once you know your goals, you can tailor your worksheet to track the relevant information. For example, if you’re trying to save for a down payment on a house, you might want to include a section for tracking your progress towards your savings goal. Next, consider your spending habits. Are you a spender or a saver? Do you tend to overspend in certain categories? By understanding your spending habits, you can create a worksheet that helps you identify and address potential problem areas. Finally, don’t be afraid to experiment with different layouts and categories until you find what works best for you. There are countless free templates available online, so try a few different ones and see which ones you find most intuitive and helpful. Add color-coding, stickers, or personal touches to make the process more engaging and enjoyable. Remember, your budget worksheet should be a tool that empowers you to take control of your finances, not a chore that you dread.

Where to Find Free Budget Worksheet Printables

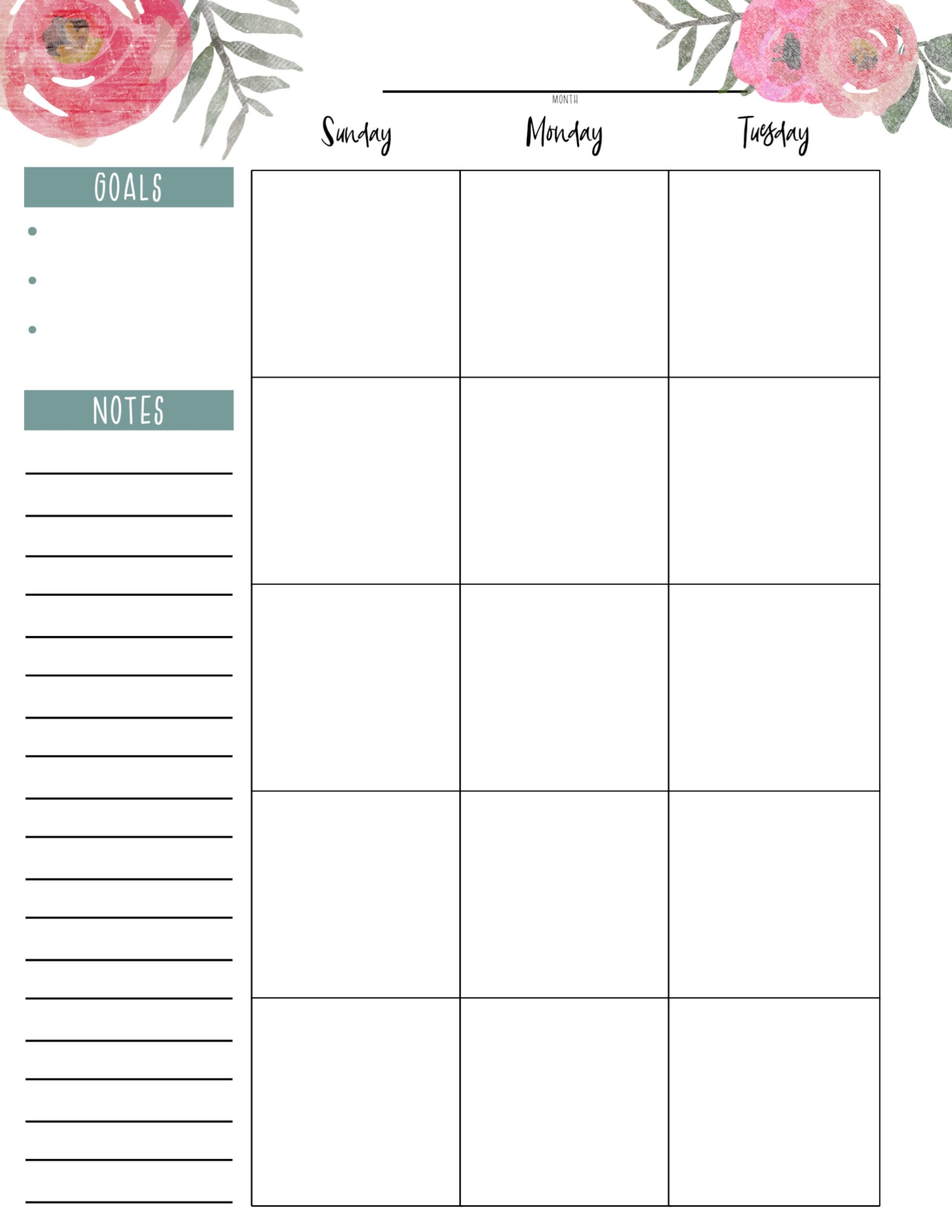

The best part about budget worksheet printables? Many amazing resources are available completely free! A simple Google search for “free budget worksheet printable pdf” will yield a treasure trove of options. Websites dedicated to personal finance often offer a variety of templates, catering to different needs and preferences. Look for reputable sources that offer clear, easy-to-understand worksheets with customizable categories. Many financial institutions, such as banks and credit unions, also provide free budgeting tools and resources on their websites, including printable worksheets. Don’t underestimate the power of Pinterest! This platform is a goldmine for visually appealing and creative budget worksheet designs. Simply search for “budget worksheet printable” to discover a wide range of options, from minimalist templates to colorful and fun designs. Remember to carefully review the worksheets you find online to ensure they meet your specific needs and are from reputable sources. Look for templates that are well-organized, easy to understand, and customizable to your unique financial situation. With a little bit of searching, you’re sure to find the perfect free budget worksheet to kickstart your financial journey.

3. Taking the Next Step

While printable budget worksheets are a fantastic starting point, they’re just one piece of the financial puzzle. Once you’ve established a budget and started tracking your income and expenses, it’s important to regularly review your progress and make adjustments as needed. Are you meeting your savings goals? Are you staying within your budget for variable expenses? By regularly monitoring your budget, you can identify potential problem areas and make corrections before they derail your financial progress. Consider supplementing your printable budget with other financial tools and resources, such as budgeting apps, financial calculators, and educational articles. These resources can provide additional insights and support as you work towards your financial goals. Don’t be afraid to seek professional advice from a financial advisor. A financial advisor can help you develop a comprehensive financial plan, tailored to your specific needs and goals. Remember, managing your finances is a journey, not a destination. Be patient with yourself, celebrate your successes, and don’t be afraid to ask for help along the way. Using a budget worksheet printable is a great first step towards achieving financial freedom, so embrace the process and enjoy the journey!

In Conclusion

The exploration of the budget worksheet printable pdf reveals its enduring relevance as a fundamental tool for financial planning. Its accessibility, simplicity, and customizable nature provide users with a tangible means of tracking income, monitoring expenses, and achieving financial objectives. The documented advantages, spanning from enhanced financial awareness to focused spending habits, underscore its capacity to empower individuals seeking financial control.

The sustained utilization of the budget worksheet printable pdf, in conjunction with evolving financial technologies and strategies, signifies its adaptability. As individuals navigate increasingly complex financial landscapes, embracing such resources becomes imperative for informed decision-making and the attainment of long-term financial stability. Further exploration and personalized implementation of these tools will foster greater economic empowerment for all.