Let’s face it, money management isn’t always a walk in the park. Between juggling bills, saving for that dream vacation, and trying to resist the siren call of online shopping, keeping track of your finances can feel like a full-time job. But what if I told you there was a simple, effective, and dare I say, even fun way to take control of your money and start building a brighter financial future? Enter the wonderful world of budget planner printables! These aren’t your grandma’s stuffy spreadsheets; they’re customizable, creative, and totally tailored to your unique needs and goals. In this article, we’ll dive deep into the benefits of using printable budget planners, explore the different types available, and give you some tips and tricks for making them work for you. So, grab a cup of coffee (or tea!), settle in, and get ready to transform your relationship with money. Because let’s be honest, a little financial freedom is something we all deserve, especially in 2024!

Why Choose Budget Planner Printables? The Magic of Paper and Pen

In this digital age, it might seem a bit counterintuitive to reach for a pen and paper when managing your finances. After all, we have budgeting apps, online spreadsheets, and all sorts of fancy software at our fingertips. But there’s something truly special about the tactile experience of using a budget planner printable. For starters, it forces you to slow down and be more mindful of your spending. When you’re typing numbers into a spreadsheet, it’s easy to gloss over the details. But when you’re physically writing down each expense, you’re more likely to think about where your money is going and whether it’s truly aligned with your values. Plus, there’s a certain satisfaction that comes from physically crossing off a goal or filling in a savings tracker. It’s a visual representation of your progress that can be incredibly motivating. And let’s not forget the customization aspect! With printable budget planners, you’re not limited to pre-set categories or rigid templates. You can create a system that perfectly fits your lifestyle, your income, and your financial aspirations. Want to track your coffee shop spending separately from your grocery budget? No problem! Need a special section for your side hustle income? You got it! The possibilities are endless, and that’s what makes budget planner printables so powerful. They empower you to take control of your financial destiny and create a system that truly works for you.

Types of Budget Planner Printables

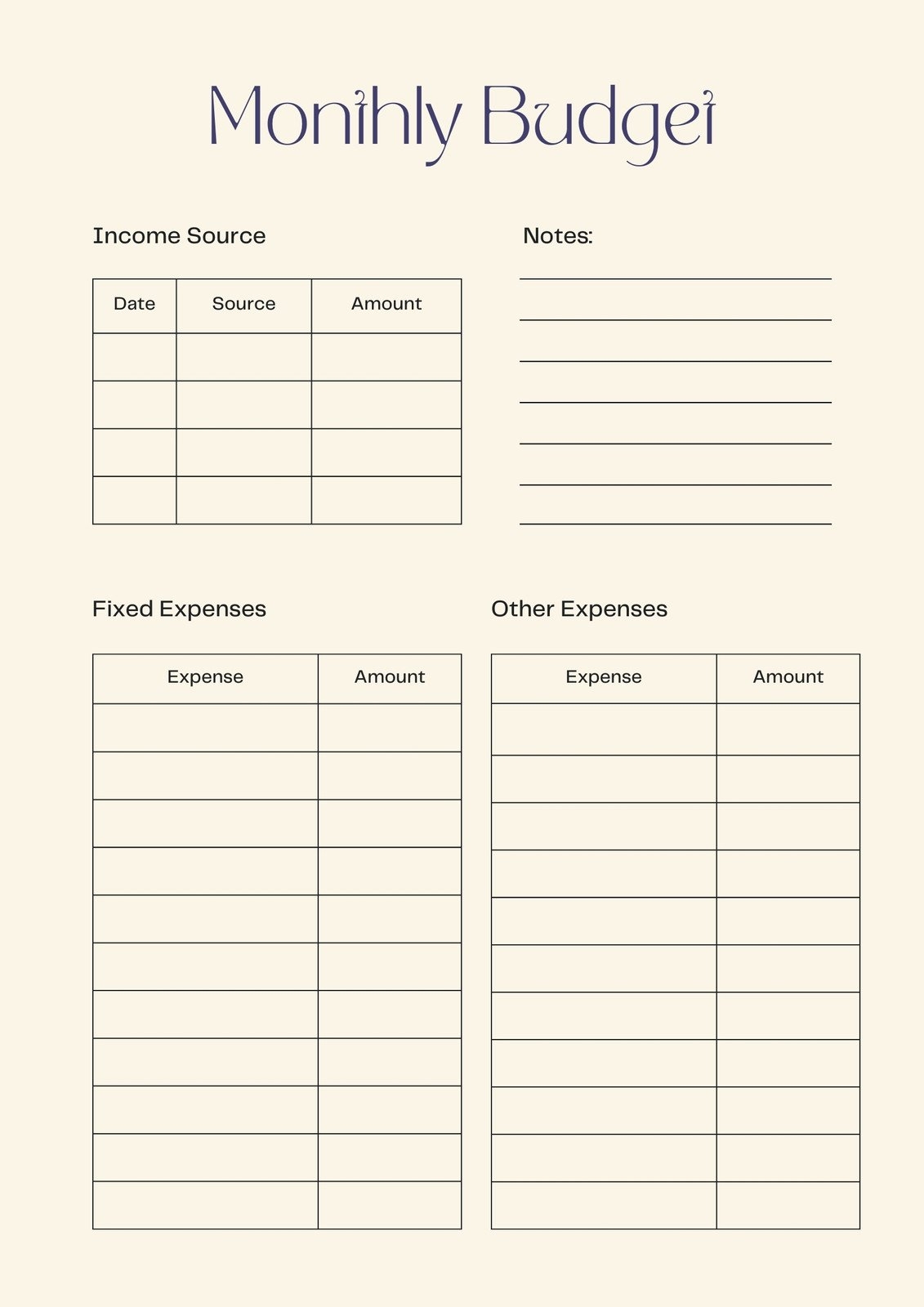

The beauty of budget planner printables is that there’s something for everyone! Whether you’re a minimalist who prefers a simple, no-frills approach or a creative soul who loves to decorate and personalize, you’re sure to find a printable that suits your style. Let’s take a look at some of the most popular types of budget planner printables: Monthly Budget Templates: These are the bread and butter of budget planning. They typically include sections for income, expenses (broken down into categories like housing, transportation, food, and entertainment), and savings goals. Some templates also include space for debt tracking and notes. Debt Tracker Printables: If you’re working to pay off debt, a dedicated debt tracker can be a game-changer. These printables help you visualize your progress and stay motivated as you chip away at your balances. They often include sections for listing your debts, tracking your payments, and calculating your debt-free date. Savings Goal Trackers: Whether you’re saving for a down payment on a house, a dream vacation, or just a rainy day fund, a savings goal tracker can help you stay on track. These printables allow you to set a target amount, break it down into smaller milestones, and track your progress over time. Expense Trackers: If you’re not quite ready to commit to a full-fledged budget, an expense tracker can be a great way to get started. Simply use the tracker to record your spending for a week or a month, and then analyze where your money is going. Bill Payment Trackers: Never miss a bill payment again with a handy bill payment tracker! These printables allow you to list your bills, due dates, and payment amounts, so you can stay organized and avoid late fees. Themed Budget Planners: For those who love a little extra flair, there are tons of themed budget planners available. From floral designs to minimalist layouts, you can find a printable that reflects your personality and makes budgeting a little more fun. Remember, the best budget planner printable is the one that you’ll actually use! So, take some time to explore the different options and find one that resonates with you.

Where to Find the Best Budget Planner Printables (Free and Paid Options)

Now that you’re convinced of the magic of budget planner printables and have a good idea of the types available, the next question is: where do you find them? The good news is that there are tons of resources online, both free and paid. Let’s start with the free options. Many websites and blogs offer free budget planner printables as a way to attract visitors and build their audience. A quick Google search for “free budget planner printables” will turn up a plethora of results. Some popular websites to check out include Pinterest (search for “budget planner printables”), Canva (which has tons of customizable templates), and various personal finance blogs. When using free printables, be sure to check the quality and ensure that the template is actually useful and well-designed. You might need to try out a few different options before you find one that you love. If you’re willing to spend a few dollars, you can find even more options on websites like Etsy, Creative Market, and Teachers Pay Teachers. These platforms offer a wide variety of premium budget planner printables, often designed by professional graphic designers and financial experts. Paid printables tend to be more customizable and feature-rich than free options. They may also come with additional resources, such as video tutorials or email support. Another option is to create your own budget planner printable using software like Microsoft Word, Google Docs, or Canva. This gives you complete control over the design and layout, allowing you to create a truly custom system that meets your unique needs. No matter where you choose to find your budget planner printables, be sure to shop around and compare different options before making a decision. And remember, the most important thing is to find a printable that you’ll actually use and that will help you achieve your financial goals.

Making Budget Planner Printables Work for You

Okay, you’ve got your budget planner printable in hand. Now what? Simply printing it out and sticking it in a drawer won’t magically transform your finances. To make budget planner printables work for you, you need to commit to using them consistently and strategically. Here are a few tips and tricks to help you succeed: Set Realistic Goals: Don’t try to overhaul your entire financial life overnight. Start with small, achievable goals, such as tracking your spending for a week or cutting back on one unnecessary expense. As you build momentum, you can gradually increase your goals. Make it a Habit: Consistency is key when it comes to budgeting. Set aside a specific time each week or month to review your budget, track your progress, and make any necessary adjustments. Treat it like an appointment with yourself, and don’t skip it! Be Honest with Yourself: Budgeting is all about being honest with yourself about your spending habits. Don’t try to hide or minimize your expenses. The more accurate your budget, the more effective it will be. Don’t Be Afraid to Adjust: Your budget isn’t set in stone. As your income, expenses, and goals change, you’ll need to adjust your budget accordingly. Be flexible and willing to adapt as needed. Celebrate Your Successes: When you reach a financial goal, be sure to celebrate! Reward yourself with something small and enjoyable, such as a relaxing bath or a night out with friends. This will help you stay motivated and keep you on track. Find an Accountability Partner: Budgeting can be tough, especially if you’re doing it alone. Find a friend, family member, or financial advisor who can provide support and accountability. Share your goals and progress with them, and ask them to check in on you regularly. Personalize Your Planner: Make your budget planner printable your own! Decorate it with stickers, use colorful pens, and add inspirational quotes. The more you enjoy using your planner, the more likely you are to stick with it. By following these tips and tricks, you can transform your budget planner printable from a simple piece of paper into a powerful tool for achieving your financial dreams.

1. Level Up Your Budgeting Game

To wrap things up, let’s explore some advanced strategies to elevate your budgeting prowess with printable planners: Zero-Based Budgeting: This approach assigns every dollar a purpose, ensuring that your income minus your expenses equals zero. It provides meticulous control over your finances and prevents wasteful spending. Integrate this strategy into your printable by creating a line item for every conceivable expense and allocating funds accordingly. Envelope System Integration: Combine the digital ease of printables with the tactile nature of the envelope system. Designate specific envelopes (either physical or virtual within your planner) for variable expenses like groceries or entertainment. Track envelope balances within your planner to prevent overspending. Sinking Funds Tracker: Plan for irregular expenses like car repairs or holidays by establishing sinking funds. Create a dedicated section in your planner to track contributions to each sinking fund, ensuring that you have the necessary funds when these expenses arise. Net Worth Calculation: Regularly calculate your net worth (assets minus liabilities) to assess your overall financial health. Design a template within your printable to record your assets (e.g., savings, investments) and liabilities (e.g., debt) and track your net worth over time. Automated Tracking Integration: While printables are manual, you can integrate them with automated tracking systems. For example, download your bank statements and use the data to populate your printable budget. This combines the convenience of automation with the mindfulness of manual tracking. By incorporating these advanced strategies, you can transform your budget planner printable into a comprehensive financial management tool that empowers you to achieve your goals with precision and confidence.

Budget Planner Printables in 2024

In conclusion, budget planner printables remain a relevant and effective tool for managing personal finances in 2024. They offer a tangible, customizable, and mindful approach to budgeting that can empower individuals to take control of their money and achieve their financial goals. Whether you’re a budgeting beginner or a seasoned pro, there’s a budget planner printable out there that can help you streamline your finances and build a brighter financial future. So, embrace the power of paper and pen, and start your journey to financial well-being today! From debt management to saving for your future, printable templates offer a range of resources to create a spending plan that is unique to you. They also provide a way to physically engage with the process of allocating your funds. It’s more than just entering numbers in a digital form. By providing a physical structure for how you manage your money, you can better track the flow of your income and expenses. Whether you’re looking for something to manage your weekly budget, your monthly savings, or your debt payoff, these resources can help you better chart a path to financial security. In 2024, they are a valuable option to consider on your financial journey. Give your budget a boost by testing out what you have learned here today. Your wallet will thank you.

Budget Planner Printables

This exploration has detailed the nature of budget planner printables, their diverse applications in managing personal finances, and the varied resources available for their acquisition. The act of physically engaging with financial data through these printables fosters a more conscious awareness of spending habits. Furthermore, the customization options afforded by these templates allow for the creation of bespoke financial strategies tailored to individual circumstances.

The capacity of budget planner printables to enhance financial literacy and promote responsible spending habits remains significant. Individuals are encouraged to consider the adoption of these tools as a means of gaining greater control over their financial well-being and fostering long-term financial stability. The consistent and disciplined application of the principles outlined herein can lead to improved financial outcomes.